At AlphaMind, we have a philosophy and ambition to help people develop critical tools, skills and behaviours that will allow traders to operate at the peak of their performance in volatile, uncertain and complex markets-based environments.

- He kept on the right path to trading success.

- He would get back on course when he strayed too far from good practice.

- He could see out the inevitable times when market conditions turned less favourable.

This list was personal to him. Now that he works as a performance coach with traders, Steven believes everyone should construct their own list of guidelines. Steven likes to distinguish between guidelines and rules. Rules can be useful, particularly when risk management is involved, however guidelines create a framework for the behaviours which help build a good trading practice.

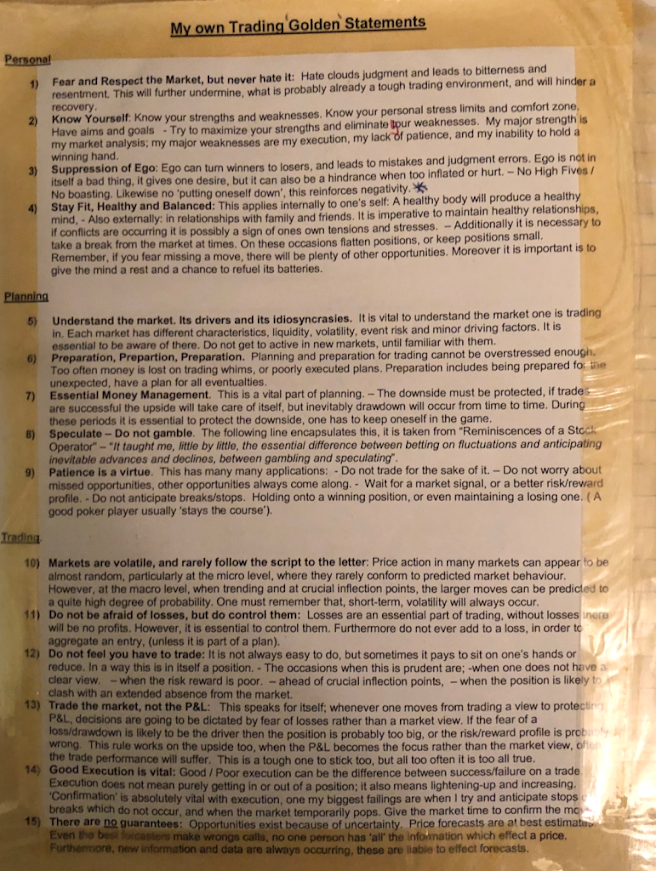

The list Steven constructed was not constant but always evolving. The one we show today was from his last list constructed back in 2007. If it was today, rather than when this one, I am sure there may a few additions and some modifications.

If you are going to construct a list, Steven suggests ensuring you follow these 3 simple principles:

- ‘Keep it Simple’; making it too complex makes it hard to follow.

- ‘Less is More’; avoid more than 20 guidelines, somewhere between 10 to 15 should be enough.

- ‘Make it Personal’; by all means feel free to copy some of these, or maybe Dennis Gartman’s well publicised lists, but do evolve and adapt them to your own circumstances and style.

Here are Steven’s "Golden Trading Guidelines” which he placed at the front of each of his Trading Journal and kept in a visible place. The image at the foot of this article shows this list in his journal.

Personal Guidelines

1. Fear And Respect The Market But Never Hate It: Hate clouds judgment and leads to bitterness and resentment.

2. Know Yourself: Know Your Strengths And Weaknesses: Know your personal stress limits and comfort zone. Have aims and goals."

3. Suppression of Ego: Ego can turn winners to losers and leads to mistakes and judgment errors. Ego is not in itself a bad thing, it gives one desire, but it can also be a hindrance when too inflated or hurt.

4. Stay Fit, Healthy and Balanced: This applies internally to oneself: A healthy body will produce a healthy mind.

Planning Guidelines

5. Understand The Market, Its Drivers and Its Idiosyncrasies: It is vital to understand the market one is trading in. Each market has different characteristics, liquidity, volatility, event risk, and minor driving factors.

6. Preparation, Preparation, Preparation: Planning and preparation for trading cannot be overstressed enough. Too often money is lost on trading whims or poorly executed plans.

7. Essential Money Management: This is a vital part of planning. - The downside must be protected, if trades are successful the upside will take care of itself, but inevitably drawdown will occur from time to time.

8. Speculate, Do Not Gamble: The following line encapsulates this, it is taken from ‘Reminiscences of a Stock Operator’ – “It taught me little by little, the essential difference between betting on fluctuations and anticipating inevitable advances and declines, between gambling and speculating.”

9. Patience Is a Virtue: This has many applications: Do not trade for the sake of it. Do not worry about missed opportunities, other opportunities always come along.

Trading Guidelines

10. Markets Are Volatile and Rarely Follow The Script To The Letter: Price action in many markets can appear to be almost random, particularly at the micro level where they rarely conform to predicted market behaviour. However, at the macro level, when trending and at crucial infection points, the larger moves can be predicted with a degree of probability.

11. Do Not Be Afraid of Losses But Do Control Them: Losses are an essential part of trading, without losses there will be no profits. However, it is essential to control them.

12. Do Not feel You Have To Trade: It is not always easy to do, but sometimes it pays to sit on one's hands or reduce.

13. Trade The Market Not Your P&L: This speaks for itself: Whenever one moves from a trading view to protecting P&L, decisions are going to be dictated by fear of losses rather than a market view.

14. Good Execution Is Vital: Good/poor execution can be the difference between success/failure on a trade. Execution does not mean purely getting in or out of a position, it also means lightning up and increasing.

15. There Are No Guarantees: Opportunities exist because of uncertainty. Price forecasts are at best estimates.

Photo of this list taken from Steven's 2007 Trading Journal:

The AlphaMind Podcast

The AlphaMind podcast is co-hosted by Steven Goldstein and Mark Randall, market veterans with over seven decades between them in the financial markets. To find out more visit the AlphaMind podcast website.

The AlphaMind Podcast is produced in partnership with 'The Society of Technical Analysts'.

Sign-Up for the AlphaMind Newsletter

The AlphaMind Newsletter is a free bi-weekly email, that explores how people develop, cultivate and grow optimal mindsets, behaviours and attitude for better and more productive performance when engaged in risk taking activities in Financial Markets. Sign-up here.

AlphaMind Trader Coaching Programmes.

The AlphaMind Trader Performance Coaching Programme

The AlphaMind Peak Performance Trading Programme

To find our more about the programmes email info@alpha-mind.net

.png)

.png)